Pet Insurance Annual Limit: What It Means & Why It Matters

Licensed Insurance Producer - Pawlicy Advisor

Pet insurance can help you avoid high costs at the veterinarian and ensure your pet always gets the care they need. Depending on the insurance plan you buy, you could save thousands of dollars in veterinary costs.

See which pet insurance is right for your best friend.

But some pet insurance policies come with what’s known as an annual reimbursement limit. If you hit your limit, your pet insurance won’t reimburse any more of your veterinary costs until the next year of your pay period.

Here’s what you need to know about pet insurance annual limits:

- What does “annual reimbursement limit” mean in pet insurance?

- What does no annual policy limit mean?

- Does pet insurance have an annual coverage limit per condition?

- What happens if I hit my pet insurance annual limit?

- What’s the best annual limit for pet insurance?

- Can I get unlimited pet insurance coverage?

- How to pick a pet insurance annual limit

- Key Takeaways

What does “annual reimbursement limit” mean in pet insurance?

An annual limit is the maximum amount of money your pet insurance provider will reimburse you for claims within a 12-month policy period (after your deductible is met).

For example, if your pet insurance annual limit is $10,000 and you pay a total of $9,000 for veterinary care throughout the year, then all of those vet bills would be eligible for reimbursement so long as the service is included with. Any amount exceeding $10,000, however, will be your responsibility to pay.

What does no annual policy limit mean?

No annual policy limit on pet insurance means that there’s no cap on how much your provider will pay out in claims for covered veterinary costs. After you hit your deductible, all of your pet’s covered veterinary expenses will be eligible for reimbursement at the rate indIcated in the policy terms.

Does pet insurance have an annual coverage limit per condition?

Pet insurance providers may also have an annual condition limit, or a ceiling cap on the maximum amount of money they will payout in claims related to a single pet health condition within a year. This type of structure is sometimes referred to as a defined benefit schedule.

Currently, Nationwide is the only provider that offers a pet insurance plan with annual condition limits (the “Major Medical” plan). However, defined benefit schedules are seen more frequently in pet wellness plans, as insurance payouts for non-medical services are typically more limited.

For example, Pets Best will reimburse up to the annual coverage limit of $30 per year for heartworm prevention in cats and dogs, while the total maximum payout for wellness benefits is $535 or $305, depending on the plan you choose.

PRO TIP: There may be additional coverage limitations on certain health conditions, such as hip dysplasia in dogs after a certain age. Always read the coverage details before enrolling in a pet insurance policy to avoid any surprises down the road.

What happens if I hit my pet insurance annual limit?

If you hit your annual pet insurance limit, you’ll have to pay for any additional veterinary expenses out-of-pocket. Other ways you can pay for vet costs include:

- You could pay with funds from your personal and/or emergency savings account.

- You could use a credit card or take out a personal loan to pay for an expensive surgery.

- You could combine pet insurance and CareCredit to fill the coverage gap.

- Some pet parents turn to friends, family, or crowdfunding sites for pet care donations.

- Some non-profits offer charity for vet care.

- Some states offer grants for pet assistance.

- Some veterinarians offer financing options for clients who can’t pay their bills.

PRO TIP: If you find that a policy’s annual limit inadequately covers your pet’s vet care expenses, then you might be tempted to switch pet insurance providers in search of better coverage elsewhere. Be careful, though, because no new company will cover a pre-existing condition (unless it’s considered curable and no symptoms are present for a certain amount of time).

A better option might be to upgrade your existing plan to one with a higher maximum payout or a lower deductible amount, especially if your vet bills stem from a pet’s ongoing medical issue because it’s already covered by your insurance company. If you do switch dog insurance or cat insurance providers, be aware of potential waiting periods that could limit your pet’s access to care.

What’s the best annual limit for pet insurance?

Pet insurance companies offer a wide range of annual limits, from as low as $2,500 to $5,000, $10,000, $15,000, and beyond. Several providers also offer pet insurance with no annual limit on coverage (though they might have a maximum lifetime limit).

So, how do you choose? Ultimately, a good annual limit for pet insurance is one that gives you peace of mind by knowing you can afford to give your four-legged friend essential vet care in the event of an unfortunate and unexpected injury or illness. As an example, emergency hospitalizations typically cost several thousand dollars, while cancer treatment could easily run upward of $15,000 or more.

Generally, here are a few points to keep in mind:

- Once you hit the maximum payout, you’ll be solely responsible for vet bills until the next policy period.

- Annual limits do not rollover. For example, if you fell $3,000 below your coverage limit in a given year, you cannot roll that amount over as credit onto next year’s policy.

- In most cases, you cannot change your annual coverage limit mid-term. For example, if your pet is diagnosed with an expensive condition after the effective policy date, you cannot retroactively increase insurance coverage.

- The higher the annual limit, the higher the pet insurance premium typically will be.

If your pet is young and healthy, you might not need a high coverage limit to provide a financial safety net. But it’s impossible to predict what will happen over a year, let alone throughout your pet’s lifetime. That’s why the best pest insurance plans are flexible and allow you to adjust your policy’s annual coverage limit.

You might set a higher maximum payout for injury-prone puppies, reduce coverage throughout their healthy adulthood, then increase your pet insurance for older dogs and cats who tend to face more illness in their late years. That being said, pet health is always unpredictable — you never know when hip dysplasia in dogs or asthma in cats might occur, two chronic conditions that are both common and often expensive to treat.

PRO TIP: If you don’t want to worry about annual limits, consider buying a pet insurance plan with unlimited annual coverage. Plans with unlimited coverage generally cost more than others, but they can be a real lifesaver when it matters most.

Can I get unlimited pet insurance coverage?

Yes, a few companies provide unlimited pet insurance with no ceiling on how much you can receive in potential claim payouts. They include but are not limited to:

- Healthy Paws Pet Insurance (All plans)

- Nationwide Pet Insurance (Whole Pet with Wellness plan)

- Farmers Pet Insurance (Best Benefits plan)

Unlimited pet insurance can provide tremendous peace of mind — so long as you're comfortable with the higher monthly payments. If the payment ever becomes uncomfortable, many insurance providers allow you to downgrade so you can keep your policy and fit within your budget.

How to pick a pet insurance annual limit

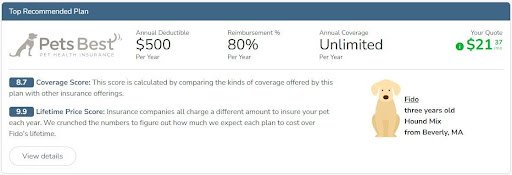

Pawlicy Advisor helps pet parents compare plans from leading providers to identify the features and benefits that matter most, such as high or unlimited annual coverage limits. Our platform is built with powerful tools that identify plans matched to your pet’s predicted needs based on their breed, age, and health condition.

You can quickly see the Top Recommended Plan, or filter results by features such as annual coverage limit, annual deductible, and reimbursement rate. If you already know what payout limit you’re looking for in a pet insurance plan, use the filter feature to easily narrow down your options and enroll within a few, simple clicks.

Start comparing annual limits by pet insurance provider with Pawlicy Advisor.

Some people can predict the future.For everyone else, there's pet insurance.

Key Takeaways

- A pet insurance annual limit is the maximum dollar amount your pet insurance plan will reimburse over a year. Some policies set annual limits on specific health conditions as well.

- If you hit your annual limit, you’ll have to pay your remaining vet expenses out of pocket. However, there may be financial resources and other types of help available to you.

- A high annual limit may cost a bit more per month, but it could bring you peace of mind. Consider purchasing a plan with an unlimited annual limit.

- Pawlicy Advisor provides tools, resources, and recommendations to help you get the perfect insurance plan for your pet and budget. You can even filter insurance quotes by annual limit.

Do you want to find the best pet insurance?

Let's analyze your pet's breed, age, and location to find the right coverage and the best savings. Ready?

Analyze My PetAbout Pawlicy Advisor

The pet insurance marketplace endorsed by veterinarians, at Pawlicy Advisor we make buying the best pet insurance easier. By comparing personalized coverage and pricing differences we can save you a ton of money, up to 83% in some instances!

Instantly Compare Pet Insurance Plans

Guides

Determine If Pet Insurance Is Worth It

Comparison Charts

Find Your State

Dog Insurance

Licensed Insurance Producer - Pawlicy Advisor

Kari Steere is a licensed P&C insurance agent in all 50 states and has focused entirely on pet insurance since 2019. As an animal lover with a rescued Terrier named Barry, when she's not helping pet owners find the perfect plan on Pawlicy Advisor, she runs a ranch in Oregon and rehabilitates any animals that come across her path.