Pet Insurance Hits New Peak In Popularity, According To Data

Reviewed by Kari Steere, Licensed Insurance Producer

Every year, the North American Pet Health Insurance Association (NAPHIA) presents industry data known as the in State of the Industy (SOI) report to inform policy writers, sellers, and holders about recent trends in the marketspace. The annual SOI survey helps support NAPHIA's mission through comprehensive research and benchmarking.

The State of the Industry report in 2022 offers a valuable, behind-the-scenes look at an industry that’s been skyrocketing over the last decade — and according to this year’s data, the exhilarating growth continues. Quick highlights include:

- The global pet insurance market was worth more than $2.83 billion at the end of 2021 and is projected to reach $32.7 billion by 2030.

- Over the previous four years, the market has more than doubled in size.

- There were over 4.41 million insured pets in North America in 2021, representing a 27.7% increase in insured dogs.

Keep reading to learn more about the state of the pet insurance industry in 2022 and the history behind the booming trend. We’ve summarized the top insights from NAPHIA’s report with additional context on what these pet insurance statistics mean and why they matter.

- NAPHIA State of the Industry (2022) Survey

- Participating Pet Insurance Companies

- Pet Insurance Products Monitored by NAPHIA

- The Rise of the Pet Insurance Trend in the US

- Pet Insurance Industry Insights in 2022

- Record-breaking year-over-year growth in total written premiums

- More and more Americans are buying health insurance for pets

- The average cost of dog insurance decreased in 2022

- Pet insurance paid out over $50k for a dog hit by a car

- Ear infections and UTIs are the most common pet insurance claims

- The US lags in pet insurance enrollment

- An increased pet population will fuel market growth

- Market opportunities set the stage for fierce competition

NAPHIA State of the Industry (2022) Survey

NAPHIA members span across the US and Canada, and include pet insurance underwriters, providers, carriers, and administrators, as well as veterinary practice groups, industry allies, and more. Each year, NAPHIA members are asked to submit data for a survey that assesses and benchmarks the current state of the pet insurance industry.

Participating Pet Insurance Companies

NAPHIA members represent 99% of pet health insurance coverage across North America, so the cumulative data within The report presented in NAPHIA’s report are based on cumulative data submitted by its members. In 2021, the participating pet insurance underwriters, carriers, and plan administrators included:

- Crum & Forster (US & Canada)

- Embrace Pet Insurance (US)

- Fetch Pet Insurance (US & Canada)

- FIGO Pet Insurance (US)

- Healthy Paws Pet Insurance & Foundation (US)

- Independence Pet Group (US)

- Lemonade (US)

- Liberty Mutual Pet Insurance (US)

- ManyPets Pet Insurance (US)

- MetLife Pet Insurance (US)

- Nationwide Pet Insurance (US)

- Petcoach / Petco (US)

- Petline Insurance (Canada)

- Pets Best (US)

- Prudent Pet (US)

- Pumpkin Pet Insurance (US)

- Spot Pet Insurance (US)

- Trupanion (US & Canada)

Pet Insurance Products Monitored by NAPHIA

A lot of the companies listed above also offer auto, home, life insurance, and other types of insurance policies but NAPHIA limits its scope to products related to pet health insurance.

- Accident-Only coverage: Accidents and injuries such as foreign body ingestion, motor vehicle accidents, lacerations, bone fractures, poisoning, etc.

- Accident & Illness coverage: Accident plus illnesses like digestive issues, infections, cancer, etc.

- Insurance with Embedded Wellness: Plans that may include early screening diagnostics, vaccinations, dental care, nutrition advice, etc.

- Endorsements: Riders like cancer or wellness endorsements.

Accident & Illness plans are the most popular type of pet insurance plan for dogs and cats, comprising 84% of the revenue share in 2021.

The Rise of the Pet Insurance Trend in the US

We know that the pet insurance market has doubled in size between 2018 to 2021 based on the data provided by the SOI survey respondents, which account for 99% of policies sold across North America. However, pet insurance penetration rates in the United States continue to hover at a low 2-3%.

This might lead you to wonder: Does the NAPHIA data accurately reflect the pet insurance trend in terms of public interest? Has there indeed been a surge in pet insurance popularity among American consumers?

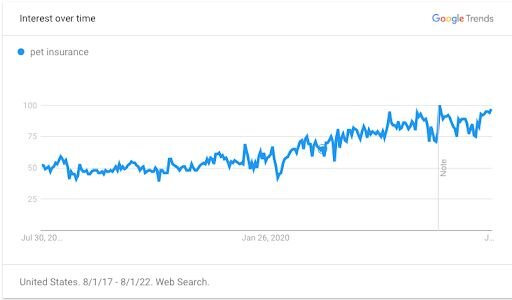

According to Google Trends data over the last five years, the answer is yes — the frequency of people searching for pet insurance information has doubled within the same time period. In fact, Google searches for the term “pet insurance” reached a peak in popularity among US internet users between June 19 to 25, 2022, trending with an all-time high score of 100.3 Looking back to January of 2018, “pet insurance” searches only received an index score of 49, meaning the topic was less than half as popular at the time.

Who was the first pet in America to be insured?

In 1982, pet insurance made its way to America when Lassie, the famous TV Border Collie, became the first US pet to be insured .4 The policy was issued by Veterinary Pet Insurance (VPI).

After that, other pet insurance companies entered the market. Insurance was initially only offered for cats and dogs, but soon expanded to cover many kinds of animals, including fish, birds, hamsters, and more.

Pet health insurance has grown steadily since 2016, but the product itself has been around for much longer than that. The first-ever animal insurance policy was penned by Claes Virgin in the 1890s with coverage protection designed for horses and livestock . A few decades later in 1924, a dog in Sweden became the first smaller pet to receive insurance coverage , and was soon followed by another policy written in Britain. These two countries continue to lead the global market’s penetration rate today.

Pet Insurance Industry Insights in 2022

More Americans are buying health insurance for pets

Market penetration rates for pet insurance have climbed to about 3.10% in Canada and 2.48% in the US. There are now more than 4.41 million insured pets across the North American region, compared to 3.45 million in 2020.

In the US alone, the total number of insured pets at the end of 2021 was 3,979,282, which is a 28.3% increase since 2020. The largest share of insured pets are located in California (19.3%), followed by New York (8.4%) and Florida (6.1%). Pet ownership statistics show that dogs remain more popular than cats, with dog insurance representing 81.7% of policies held.

That said, cat insurance has grown substantially over time. Since 2018, cat insurance enrollment saw an increase in of 113% compared to just 86.2% for dogs.

The record number of pet purchases and adoptions during the pandemic, along with ongoing work-from-home arrangements, and the growing need to offset rising veterinary costs all contribute to the industry's unprecedented growth in recent years.

The average cost of dog insurance decreased

Although the cost of pet insurance premiums for cats went up slightly, the average annual premium for dog insurance decreased. Dogs represent a larger segment of the market, meaning more people benefited from this pet insurance trend.

The average cost of an Accident & Illness plan for a dog is $48.66 per month or $583.91 per year. In comparison, the average cost of an Accident & Illness plan for a cat is $28.57 per month or $342.84 per year.

Pet insurance paid out over 50K for a dog hit by a car

The top pet insurance claim for dogs in 2021 was $50,602 paid for a five-year-old female Terrier mixed breed from New York who was hit by a car. The highest claim for cats was $21,941 paid to a five-year-old male domestic medium hair cat for foreign body ingestion.

Here are the highest pet insurance claims for dogs and cats paid out per incident in 2021:

| Breed | Sex | Age | Claim Paid Amount | Location | Condition |

|---|---|---|---|---|---|

| Terrier Mix | F | 5 | $50,602.67 | Brooklyn, NY | Hit by car |

| French Bulldog | F | 2.2 | $49,939.96 | Edmonton, Can | Gastrointestinal |

| German Shepherd | M | 7 | $43,802.48 | NJ | (GDV) |

| Pointer Mix | M | 3 | $43,202.12 | Leesburg, VA | Trauma |

| Labrador Retriever | M | 11 | $38,503.83 | Davis, CA | Kidney Disease |

Breed | Sex | Age | Claim Paid Amount | Location | Condition |

|---|---|---|---|---|---|

Domestic Medium Hair | M | 5 | $21,941.14 | Yonkers, NY | Foreign Body Ingestion |

Domestic Shorthair | M | 1 | $16,737.23 | San Diego, CA | Dehiscence |

Mixed Breed Cat | M | 0 | $15,162,13 | Phoenix, AZ | Lymphoma |

Domestic Shorthair | F | 10.8 | $14,382.38 | New York, NY | Kidney Disease/Failure |

Mixed Cat | F | 6 | $14,377.15 | West Covina, CA | Urgent care and specialist treatment |

Ear Infections and UTIs were the most common pet insurance claims

According to the NAPHIA’s pet insurance data, ear infections and UTIs account for the most claims in dogs and cats. When it comes specifically to dog insurance statistics, the top five most common claims of 2021 were:

- Ear infections

- Gastroenteritis

- Diarrhea

- Skin Conditions (Infections, Allergies, Mass)

- Urinary Tract Infections

Cats, on the other hand, were most commonly affected by the following:

- Urinary Tract Infections

- Diabetes

- Gastroenteritis

- Ear Infections

- Diarrhea

The US lags in pet insurance enrollment

Due to the surge in pet adoptions during the COVID-19 pandemic, stay-at-home work conditions, more people considering their pets to be family members, and the rising cost of vet visits amid record-high inflation, the pet insurance market is growing rapidly all over the world — not just in North America.

More and more people have pet insurance in countries like the U.K., Sweden, Australia, and Germany. While pet insurance popularity has only recently started to trend in the US and penetration rates still remain low, as many as 23% of pets in the U.K. and 30% of pets in Sweden had pet insurance as early as 2017 .5

As a result, the global pet insurance industry is predicted to expand its past its market size valuation in 2021 (USD 8.3 billion) at a compound annual growth rate (CAGR) of 16.7% between 2022 and 2030; in 2022, the pet insurance market is valued at USD 9.5 billion, meaning the revenue forecast is estimated to reach $32.7 billion by the year 2030 .5

Europe dominated the pet insurance market in 2021, holding over 43% of the total revenue share — which is reasonable, considering the 90 million households in the European Union that owned at least one household pet in 2020, including:6

- 113 million cats

- 92 million dogs

- 48 million birds

- 29 million small mammals

- 16 million aquatic animals

- 11 million reptiles

Increased pet population will fuel market growth

As the pet population booms across Europe and North America, insurance companies like Trupanion , Nationwide , PetFirst , Fetch Pet Insurance (formerly PetPlan ), and Embrace are introducing additional service offerings to support the different needs of pets. The availability of these new policies is expected to add more fuel to the market growth.

Interestingly, pet insurance for horses and small mammals is predicted to be the fastest-growing market segment at a CAGR of 17% . That means as the pet insurance trend continues to grow over the next few years, we’ll likely see a spike in owners who obtain policies for pets such as rabbits, guinea pigs, and livestock in the US.

Recent studies show that people who sign up for pet insurance tend to take their pets to the vet more often since it’s easier to afford the cost of care with less financial burden incurred.7 If that trend continues as pet insurance becomes more popular and inclusive among other domestic species, we can expect to see another wave of pets enjoy better veterinary care at a more frequent rate — which is a great step forward for animal welfare.

Market opportunities set the stage for fierce competition

By all expert accounts, the pet insurance industry is poised for exponential growth between now and 2030. With such low penetration rates in North America, you can count on US pet insurance companies to strategically compete against one another in the pursuit of potential customer acquisition.

Remember that no two providers are the same. Doing your research and reading the fine print is crucial if you want to find the best pet insurance that suits you and your pet’s unique needs. There are certain cat and dog breeds more prone to health issues than others, so you’ll want to be sure that your policy has coverage you can count on in case a medical condition arises at some point in your pet’s life.

Pawlicy Advisor can save you hours of time and stress by recommending great pet insurance plans based on your personal preferences as well as your pet’s breed, age, and location. We can help you compare pet insurance plans from top providers and go over the details in terms you can understand. With Pawlicy Advisor, you can easily sign up for pet insurance online within a matter of minutes, and feel confident that you’ve found the right solution at the lowest cost guaranteed.

Click the button below to get recommended plans, or learn more about how pet insurance works and why it’s become so popular in recent years.

Compare Top Pet Insurance Companies Side-by-Side

Use Pawlicy Advisor to get personalized quotes from leading brands and see how each plan stacks up — instantly.

100% free to use. No fees. No commitment.

Final Thoughts

- In 2022, the North American Pet Health Insurance Association (NAPHIA) published the results of their 2021 survey in the State of the Industry report and found that the pet insurance sector exceeded $2.83 billion in 2021, representing a 30% increase compared to 2020.

- There are now more than 4.4 million insured pets across North America, versus 3.4 million the year prior. Since 2018, the number of pet insurance insurance policies written for dogs has grown by 86.2% and 113% for the number of policies sold to cats.

- The number of people who have pet insurance spiked largely due to the pandemic, remote working conditions, increased pet adoption rates, and intensified human-to-pet bonds at home.

References

- NAPHIA, "State of the Industry 2022", Accessed

- NAPHIA, "Members

- Google Trends, "Pet Insurance"

- Insurance Information Institute, "Facts & Statistics: Pet Ownership and Insurance"

- Grandview Research,"Pet Insurance Market"

- European Pet Food, "Statistics"

- Nationwide Pet Insurance, "Study: Pet Owners with Pet Insurance More Likely to Seek Care"

Do you want to find the best pet insurance?

Let's analyze your pet's breed, age, and location to find the right coverage and the best savings. Ready?

About Pawlicy Advisor

The pet insurance marketplace endorsed by veterinarians, at Pawlicy Advisor we make buying the best pet insurance easier. By comparing personalized coverage and pricing differences we can save you a ton of money, up to 83% in some instances!

Instantly Compare Pet Insurance Plans

Guides

Determine If Pet Insurance Is Worth It

Determine If Wellness Plans Are Worth It

Comparison Charts

Find Your State

Dog Insurance

Do you want to find the best pet insurance?

Let's analyze your pet's breed, age, and location to find the right coverage and the best savings. Ready?

Analyze My PetAbout Pawlicy Advisor

The pet insurance marketplace endorsed by veterinarians, at Pawlicy Advisor we make buying the best pet insurance easier. By comparing personalized coverage and pricing differences we can save you a ton of money, up to 83% in some instances!

Instantly Compare Pet Insurance Plans

Guides

Determine If Pet Insurance Is Worth It

Comparison Charts

Find Your State

Dog Insurance

Senior Content Manager

Kaelee Nelson is a die-hard dog mom, part-time dog trainer, and ultimate pet enthusiast. She recently rescued a puppy named Zoey who went from the streets of Mexico to the big lights in L.A. after Kaelee helped her become officially studio-trained for production work, with the goal of strengthen her dog's confidence as well as the bond they share. Kaelee remains passionate about pets in her role as Content Manager by helping owners prepare for the financial burden that often comes with giving our furry BFFs the best care possible. Enrolling Zoey in a pet insurance policy was a no-brainer for Kaelee, as it enabled her to get reimbursed for vet costs like spaying, vaccinations, routine care, and more.