Finding the right pet insurance plan for your pets can be a daunting challenge. With so many options on the market, and too many variables that relate to coverage and pricing - how do you sift through all the noise?

Veterinarians often keep informational brochures about insurance plans in their offices, though there should be a better way to compare pet insurance options aside from reading every provider's marketing brochure or filling out a form on every provider's website.

Now, there is actually a free tool that solves this problem.

Regardless, you should understand the pros and cons of buying pet insurance, what to avoid when comparing plans, and what to look for to find the perfect policy for your budget and your pet’s coverage needs - no matter which provider you choose.

- The Pros and Cons of Pet Insurance

- What To Avoid with Pet Insurance Providers

- How to Find the Right Pet Insurance Provider

- How to Get The Best Pet Insurance Plan for Your Unique Pets

The Pros and Cons of Pet Insurance

Insurance is a different kind of asset. Rather than paying for a service, you are actually hedging your risk.

Like auto-insurance or renters insurance, you only use it if life takes a turn for the worse. It protects you from unforseen circumstances... and pets tend to be more prone to trouble.

So, when considering the pros and cons to purchasing a pet insurance policy, you must understand that not needing to use your insurance is arguably better than having to use it.

To answer the question, "is pet insurance worth it," you must ultimately base the decision on unique breed-risks, age, and how much you value peace of mind.

Pet Insurance Shopping 101

Your "monthly premium" is what your pet insurance costs each month to keep the plan active.

Your "annual deductible" is how much you must pay out of pocket, annually, before your insurance starts covering expenses.

Your "benefits" relate to how much coverage your pet receives from your plan and how much you’ll be reimbursed for your veterinary expenses.

While most standard pet insurance plans offer substantial coverage, you can customize your plan's costs by changing the deductible amount, reimbursment rate, or coverage. For example, if your plan includes a "wellness" component and you remove it, you’ll save money on your monthly premiums, but you’ll have to pay out of pocket when your pet receives certain routine care.

The pros and cons of different insurance policy configurations will vary for each pet. Let's get into it.

The Pros of Pet Insurance

There's a reason many veterinarians recommend their patients consider pet insurance. Not only will it help cover the costs of treatment (and prevent unnecessary euthenasia or abandonment due to economic factors), but also because it tends to drive pet parents to be more proactive in keeping pets healthy.

Straightforward Billing

If your personal health insurance plan gives you a headache, you may be reluctant to sign up for a pet health insurance plan - but don't fret!

Pet insurance billing is much more streamlined than human health insurance billing.

For context, human health insurance companies negotiate with healthcare providers and pay them directly. Much of this happens behind the scenes, and you don’t know how much you owe out of pocket until you get your healthcare bill.

With pet insurance, your insurance provider usually does not pay your veterinarian directly. They pay you. You pay your veterinarian at the time of service, then you get reimbursed ASAP for the cost of veterinary care based on your plan (many reimburse in less than two weeks).

It’s also easier to calculate how much of your vet bill will be covered. You’ll always know what percentage of expenses will be reimbursed after your deductible. Many put their vet bills onto a credit card and pay off the balance once they're reimbursed by the insurance provider (see How To Use Pet Insurance).

You Can Go to Any Vet You Choose

Since most pet insurance providers reimburse you instead of paying the vet directly for veterinary expenses when you make a claim, there are no networks to worry about when have a policy.

You can to any vet practice you'd like, even if you switch plans or are signing up for a pet insurance plan for the first time.

Protect Your Finances from Unexpected Costs

Sometimes, a routine checkup at the vet turns into a much bigger bill than you expected.

Maybe your veterinarian believes your dog has hip dysplasia and wants to do an X-ray, or maybe they’re concerned your cat might have an infection and they want to run a blood test. Even dental cleaning can be expensive, especially if your pet needs to be sedated for your veterinarian to do the cleaning.

Most of the costs you incur at the vet won’t be as high the costs you see at a human hospital, but they do add up.

With pet insurance coverage, you know you’ll be reimbursed for these unexpected costs.

NOTE: Large expenses can also lead to debt, where interest charges will increase overall costs even further.

Get Your Pet Emergency Care When They Need It Most

Pet insurance can be a lifesaver when the worst happens and your pet needs lifesaving emergency care. 1 in 3 pets will need emergency veterinary treatment each year. An unexpected visit to the veterinarian can easily cost $1500 — a cost most Americans can’t afford out of pocket — and emergency care can cost even more.

In the worst situations, it may take multiple tests to determine exactly what’s wrong with a pet, and it may require multiple visits to the animal hospital to get treatment. The pet may need to be kept comfortable during the process, and they may need to receive long-term treatment to manage their condition. This can cost thousands of dollars.

As such, pet parents without pet insurance who bring their pets to the ER can sometimes be forced to make an impossible choice with little notice: Get their pet the care they need or avoid going into debt.

In the absolute worst cases, the pet must be euthanized because the owner can’t afford the cost of care. This is called “economic euthanasia.” It’s a scenario no one wants to think about, but it’s one that occurs all too often.

With the right pet insurance plan, you know you’ll never have to make that impossible choice. Instead, you can let your veterinarian make the best possible medical treatment plans for your pet and deliver gold standard care.

Peace of Mind

It goes without saying, but the biggest perk of any type of insurance is the peace of mind it can bring.

When you’re insured, you know that you aren’t going to have a major financial set-back if your pet gets sick or injured. If your puppy comes down with a genetic disease that requires expensive medication to stabilize, you'll be relieved when you insurance covers the monthly prescription costs.

As Dr. William Hodges, DVM, says, "Pet insurance grants finanacial peace of mind so that treatment conversations can be about what’s the right thing to do, instead of how much it will cost."

All you'll need to worry about is getting your pet to the vet, not the bill you’ll get from the clinic.

The Cons Of Pet Insurance

Again, pet insurance is different kind of asset you pay for. It's a way to hedge risk and protect yourself from the large expenses often found in treating pet illness or injury. So when you think about the "cons," know that the cons of not having protection could be far greater.

It Does Cost Money (Like Most Things)

There are already plenty of expenses associated with being a pet parent. You must pay for the adoption, their food, their toys, and perhaps even their licensure in your city or town. Adding pet health insurance to your monthly expenses might seem avoidable.

But keep in mind that your insurance plan is an investment against the potential risk of your pet getting sick or injured. It's there to help you reduce the cost of their lifetime care. If your next veterinary bill ends up being hundreds or even thousands of dollars, being reimbursed for the cost will have been worth paying the monthly premiums for your plan.

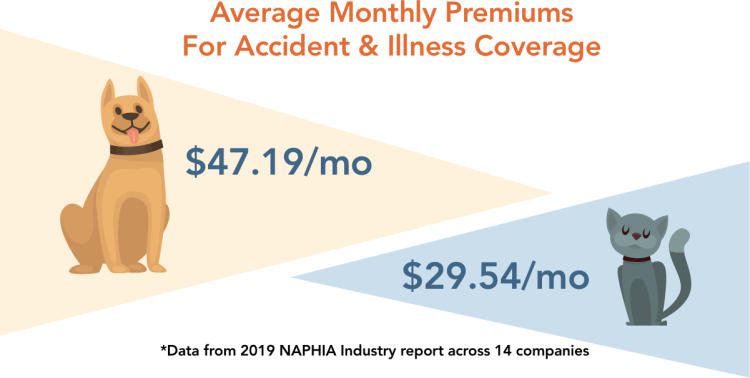

Additionally, pet insurance really not as expensive as other coverage plans you might already have, such as human health insurance or auto-insurance. On average, pet insurance costs about $47/mo for dogs and $29/mo for cats. The younger and healthier your pet is when you enroll, the cheaper your monthly premiums will be!

NOTE: Many employer's have begun offering pet insurance as an employee benefit. In this case, getting pet insurance is a no-brainer! Just do it. You'll be glad you did. Tell your employer or HR manager why they should offer pet insurance as an employee benefit

Making Sure You're Covered For Everything Can Be Tricky

There are no pet insurance plans that cover pre-existing conditions. If your pet gets sick or hurt before you sign up for a pet insurance plan, you won’t be able to be reimbursed for the treatment of that particular illness or injury. However, there are plans that will cover pre-existing conditions if they're curable and a certain waiting period has passed without symptom recurrence.

If you sign up for an "accident-only" plan, you won’t be covered if your pet needs treatment for an illness. Nor will you receive reimbursements from your insurance company for routine care unless you sign up for a "wellness plan" add-on.

That said, most pet insurance plans do have a wide net of coverage. Just be aware of what type of plan you’re getting and what conditions it covers before you sign up.

Remember that free tool I mentioned that solves the problem of finding the best pet insurance for your unique pet, regardless of the provider? Well, it's a big help in ensuring you find a plan that covers your speific breed-risks and conditions too. I'll talk more about it below, but, if you'd rather not wait, it's called Pawlicy Advisor. It's the best tool for comparing and buying pet insurance.

What To Avoid When Comparing Pet Insurance Providers

You should only purchase plans from reputable companies, and you’ll need to read the fine print to ensure you’re getting the plan you’re expecting. You’ll need to do your due diligence.

Here’s what to look out for.

Avoid Pet Insurance Companies That Are Very Small

There's 14+ pet insurance companies out there, and that number is growing every year. In general, it's a safer bet to go with a company that's been around for a few years. This is because newer providers may change their premiums more drasticaly (and more frequently) as they figure out their own business metrics.

Established companies have a repuatble and trustworthy customer experience (and they're a lot less like to just close up shop and disappear).

Here's some __established pet insurance companies you can trust__, hands down:

A Note On Pet Insurance Reviews

Review site should not be a deciding factor in your shopping experience. Review sites can skew your perception as many negative reviews may simply be the result of a bad fit rather than a bad product.

They can provide context on customer experience, but please use data-driven factors rather than counting who has more "likes."

Avoid Slow Reimbursement Speeds

Most people operate on a monthly budget. If you have an expensive vet bill, you’ll want to be reimbursed as quickly as possible so you can pay other expenses that month.

When using pet insurance, you should be reimbursed by your pet insurance company within an expected time once you make a claim. Many insurance plans take fewer than 14 days to reimburse claims.

If you discover during your research that a pet insurance company has a long waiting period for reimbursement, you might want to consider other plans. You can also check customer reviews to determine if a company is true to the reimbursement speeds they claim on their website or other sales materials.

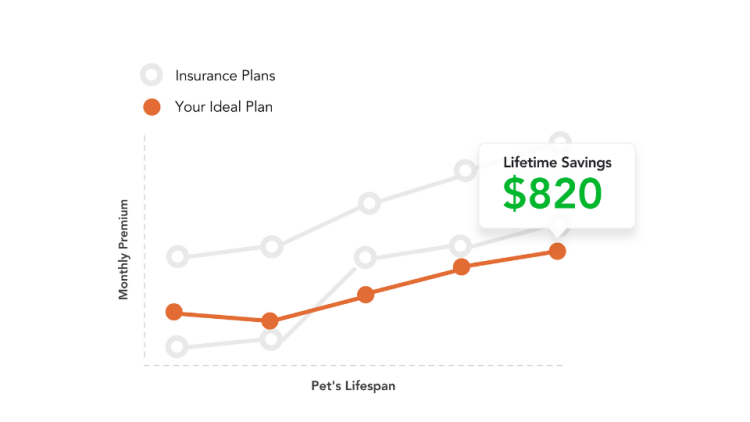

Avoid Higher Lifetime Costs When Possible

It can be hard to compare pet insurance plans across the market and get a clear view of your best options, particularly when it comes to understanding what the plan will cost over the lifetime of the pet.

To avoid paying too much for coverage across the years to come, your best bet is to get quotes from several leading pet insurance providers and dig into the fine print of each policy to figure out an estimation of how much each policy might increase as the pet ages.

The plan that's cheapest today, might actually cost more in the long run if the premium increases by 30% - versus another that might have a higher premium now but only increases by 10%.

Again, this is where that free tool I mentioned, Pawlicy Advisor, comes in really handy. There's no other tool like it. Pawlicy Advisor will actually scan hundreds of policy variations across top providers to help you easily identify the polcies with the best lifetime value.

How to Find the Right Pet Insurance Provider

Before you start comparing policies, you need to collect some important information.

Information to Collect Before Shopping for Pet Insurance

Before you start shopping for pet insurance, you’ll need to have a few details about your pet(s) and their health history on hand:

- What type of pet you’d like to insure (dog or cat)

- How many pets you have

- Your pet’s gender

- Your pet’s age

- Your pet’s weight

- What breeds apply to your pet

- Whether your pet is purebred or a mixed breed

- Whether your pet has a pre-existing condition

Get Multiple Quotes From Multiple Top Providers, Simultaneously

Okay, you have two options here.

You either can fill out forms on every provider’s website and blow up your inbox (and your sanity).

Or - you can use Pawlicy Advisor, fill out one form and automatically get real-time quotes across top providers simultaneously.

Click the button above to instantly get multiple quotes across top providers.

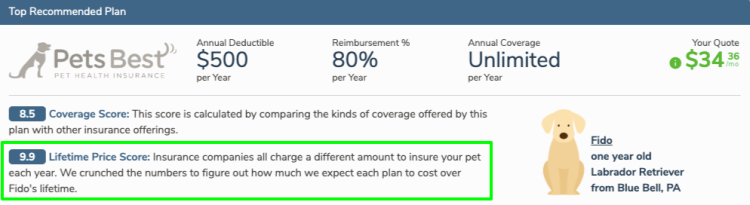

Pawlicy Advisor will take you pet's unique info and analyze hundreds of policies and real-time quotes. You'll then get a personalized recommendation.

Your “Top Recommended Plan” is the best plan available for your pet based on the information you provided, as well as price and coverage.

(Pretty cool, right?)

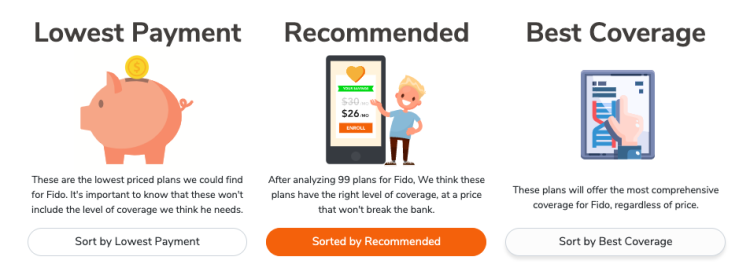

Above your top recommended plan, you’ll see options to sort and filter your results based on cost, coverage, and specifications like your reimbursement percentage and your annual deductible.

If lowest cost is most important to you, don’t sweat it. Just select “Sort by Lowest Payment,” and you’ll see the most affordable quotes within your search results. Same if you'd prefer maximum coverage, just select "Sort by Best Coverage." Of course, it's really about finding the prefect balance between the two - in which case you should use "Sort by Recommended."

Once you have one or more policies that look like a good fit, you should compare them side-by-side.

Comparing Different Pet Insurance Policies

If you don't use Pawlicy Advisor you'll need to create a spreadsheet, fill out forms on every provider’s website, record your quote options with notes on coverage, exclusions, waiting periods, and dive into the fine-print for each policy to uncover and exclusions that are relevant to your specific breed.

If you like doing tedious homework late into the night, that first option is for you.

If you use Pawlicy Advisor you can create a comparison chart with one click.

(#mindblown)

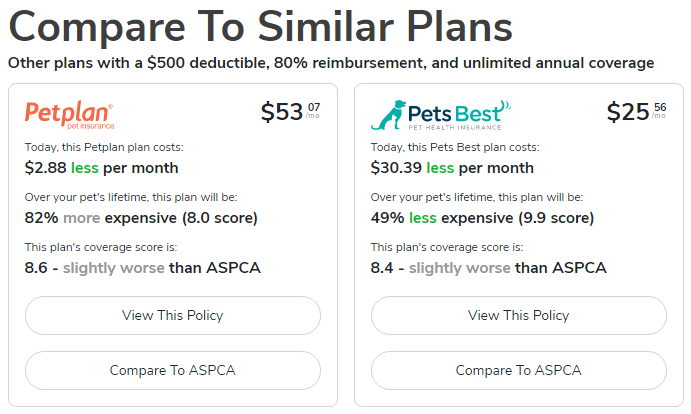

Once you click on into any quote's details, you’ll see how similar options compare at a glance.

But the real kicker here is being able to create a comparison table in one click. The comparison chart will give you an idea of how much you can save on each policy and how coverage differs between them.

Creating A Comparison Chart

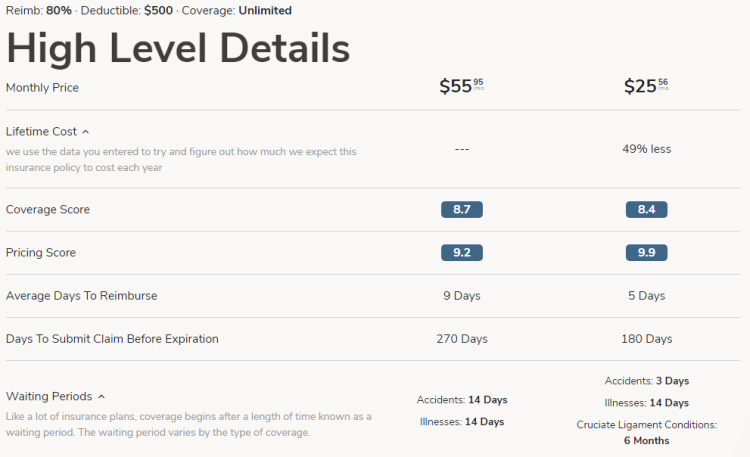

So, select a plan to compare and view the high-level details of each plan side by side:

You’ll see more detailed information about how the plans stack up. In the example above, both policies have a reimbursement rate of 80% and a deductible of $500. They also offer Unlimited coverage, which means there is no annual cap on reimbursements!

The “Lifetime Cost” calculates in how much the cost of your plan may naturally increase over your pet’s lifetime. You can also view each plan’s average time to reimburse, their waiting periods for coverage to kick in, your timeframe for submitting a claim, and other information.

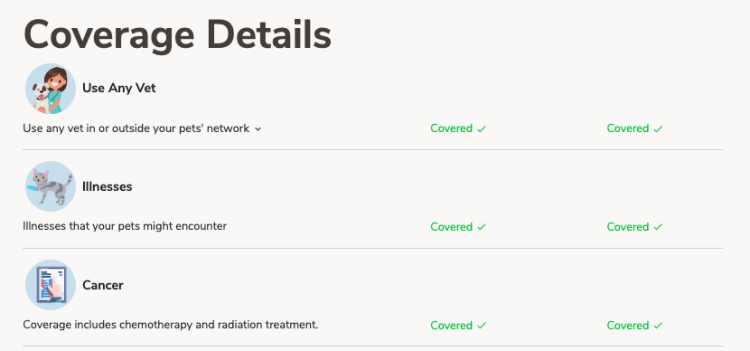

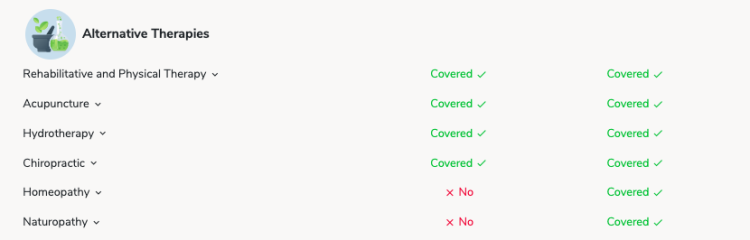

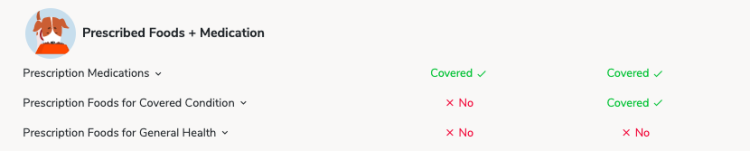

Next, to see information about what each plan actually covers, just scroll down to "Coverage Details."

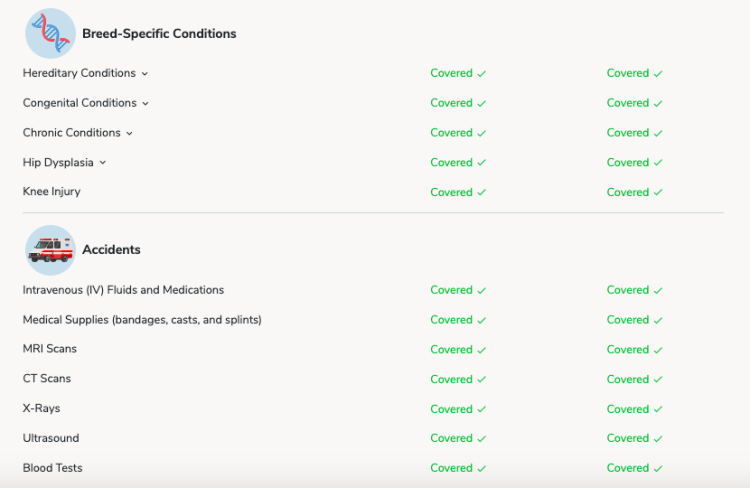

Review all coverage details, such as whether or not breed/genetic conditions are covered.

You'll also see details on alternative therapies, prescribed foods/medications, and much more.

And, you can trigger a unique comparison chart for any of the policies pulled through Pawlicy Advisor.

Clearly this method of comparing pet insurance plans is much easier than requesting quotes from individual insurance companies and writing each line item down. Give it a whirl - it's free.

How To Get the Best Pet Insurance Plan for Your Unique Pets

It’s best to shop for pet insurance while your pet is still young and healthy. If you wait until they get sick, you won’t receive coverage for that (now pre-existing) condition. There may also be a waiting period for when coverage will kick in, so you’ll be responsible for any veterinary expenses that occur in the meantime. The sooner you enroll before your next vet appointment the better.

Naturally, not everyone looking for pet insurance is shopping for a young animal that has no pre-existing conditions. That’s why Pawlicy Advisor selects the best plans available based on the unique needs of your pet.

For example, if you have a senior pet, Pawlicy Advisor will still be able to get insurance coverage for them and automatically find the right provider to do so. (Just keep in mind that your premiums will likely be higher than if you signed up when your pet was younger.)

Pet insurance will typically last as long as you pay the monthly premiums, but your - as mentioned above - premiums may increase as your pet gets older. So pay special attention to the “Lifetime Cost” score associated with your plans on Pawlicy Advisor.

Find Your Ideal Plan via Pawlicy Advisor

Choosing the best pet insurance plan for your pet is an important decision, but it doesn’t need to be a difficult one.

With Pawlicy Advisor, you can find and buy a plan that fits your budget and provides the best level of coverage for all your fur-babies.

There's a reason so many veterinarians trust Pawlicy Advisor :)