Is Cat Insurance Worth It? Ask An Expert

Reviewed by Kari Steere, Licensed Insurance Producer

Contributions by Edwin Plotts

Taking on the care of another living being is a big responsibility. When your pet is young and healthy it might not seem necessary to pay monthly premiums for pet health insurance, but investing in pet insurance early can save you thousands of dollars down the road. More importantly, it will ensure your pet has access to care when they need it the most.

Protect your wallet and your best fur friend with a pet insurance policy.

Pet insurance is a valuable investment that can keep your four-legged family member healthy and prevent you from spending too much money on vet care.

How do I know this? Well, my fiance (@sarazoekittens) and I rescue, rehabilitate, and foster cats in Brooklyn, NY. We've seen our fair share of vet bills, and my own cat Greyson was lucky to have pet insurance to reimburse us for a $1,200 dental extraction (due to feline stomatitis).

- The average cost of annual vet care for cats

- What does cat insurance cover?

- What cat breeds are prone to health problems?

- How to compare cat insurance plans

- How to buy pet insurance for cats

- Benefits of cat health insurance

- Final verdict: is cat insuance worth it?

- Key Takeaways

The average cost of annual vet care for cats

Caring for a cat costs approximately $1,070 a year. You’ll shell out money for nutritious food, toys, climbing trees, kitty litter, a litter box, and training in the first year - but that doesn't include the cost of vet visits.

Unplanned Vet Visits

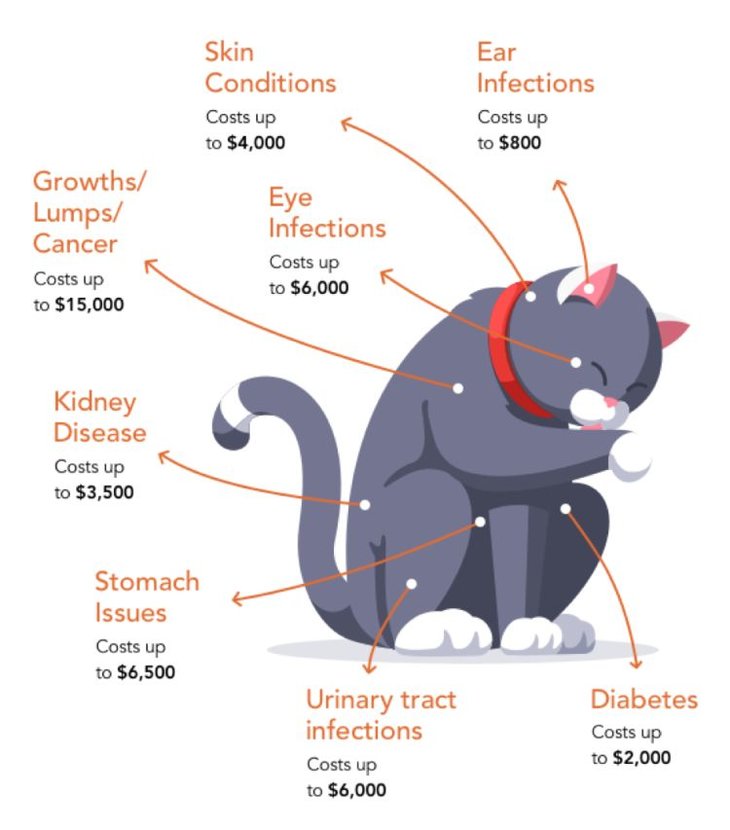

Cats are also prone to illnesses that can break the bank without the security of basic pet insurance.

Here’s look at some of the most common illnesses in cats that illustrate how quickly pet care costs could add up:

-

Feline urinary tract infections (UTIs) - $6,000

UTIs are the most common health issue in cats, especially older females. Lab tests, antibiotics, and even surgeries can total $6,000. If not treated properly, they can easily recur.

-

Diabetes - $300/month ($1,000+ if hospitalized)

Diabetes is a costly condition for cats as well as humans. Cat owners might spend $300 a month on insulin, and $1000+ if your cat is hospitalized for ketoacidosis.

-

Kidney disease - $5,500-6,000 (+$500 per treatment)

Kidney disease is especially expensive and complicated to treat. Depending on the type (chronic or acute/sudden onset), kidney treatments can cost $3,000 for kidney-stone removal surgery, $2,500-3,000 for the first week of dialysis, then $500 per treatment afterward if needed.

Cats are also susceptible to communicable diseases such as ringworm and chronic conditions like hyperthyroidism that requires ongoing hormone therapy to treat.

According to data published by PetFinder1, cat owners can expect to pay anywhere from $110 to $550 per year for veterinary care and vaccines, plus up to $200 for flea and tick prevention. This is, of course, assuming your cat doesn’t have a serious condition that requires treatment.

If they develop any of the expensive conditions above, the cat's vet bills can be as high as $7,000 or more in a single year.

Regular Vet Checkups

Like dogs, most cats should visit a licensed veterinarian at least once a year for a wellness check. This gives your veterinarian to check for problems that you may not be aware of just by observing your cat’s behavior at home.

NOTE: If you adopt a kitten or rescue an older cat, you’ll need to bring them to the vet more often.

According to Barry Veterinary Hospital in Miramar Beach, Florida, “Exactly how often your kitty will need to attend routine veterinary care exams will depend on her age and how healthy she is. Initially, your vet will probably recommend that your furbaby has a check-up every 12 months and annual wellness appointments tend to be standard for young and adult cats. If your kitten hasn’t received her full set of vaccinations, you may also need to attend appointments for these to be carried out. You will also need to schedule a visit to arrange to get your kitty spayed/neutered.”

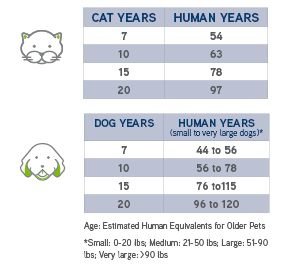

Thanks to dietary improvements, medical advancements, and preventive care, pets are living longer than ever. Keep in mind that cats often live longer than larger breeds of dogs, and the AVMA says a cat that's just seven years old is equivalent to a 54 year-old human2.

(Image source: AVMA)

As your pets get older, they may need to go to the veterinarian more often. The AVMA states, “Geriatric pets should have semi-annual veterinary visits instead of annual visits so signs of illness or other problems can be detected early and treated. Senior pet exams are similar to those for younger pets, but more in-depth, and may include dental care.”

What does cat insurance cover?

Cat insurance covers eligible vet services that you pay for out-of-pocket, such as unexpected surgey, diagnostic testing, exam fees, prescription drugs, and more. There are three types of insurance plans for cats, each with different degrees of coverage: accident-only, accident/illness, and wellness plans.

Accident-Only Plans

This provides health insurance for vet costs exclusively due to accidents. Physical injuries like broken bones are usually covered under accident-only plans, including reimbursement for essential tests like CT scans and X-rays.

Accident/Illness Plans

This is the most popular type of pet insurance plan for cats, offering greater protection with coverage for both accidents and cat illnesses. If your cat breaks their leg, you’ll be covered, just as you’d be covered if your cat were to get sick. According to ASPCA, illnesses common in cats include:

- Cancer

- Diabetes

- Feline Immunodeficiency Virus (FIV)

- Feline Leukemia Virus (FeLV)

- Heartworm

- Rabies

- Ringworm

- Upper respiratory infections

- Intestinal parasites like tapeworms

If you sign up for cat insurance before your pet develops any these conditions, an accident/illness plan with good coverage will likely reimburse a portion of all related costs once you've met your deductible. This can be a lifesaver.

For example, cancer often requires expensive radiation or chemotherapy treatments, while feline leukemia virus (FeLV) does not yet have a definitive cure, so pets must make regular trips to the vet for therapies, exams, and observation. If your cat has chronic kidney disease, you may need to buy regular supplements or medications to treat your pet. Unfortunately, renal (kidney) failure is common in older cats, but pet insurance offers a financial safety net should your cat require emergency hospitalization.

Wellness Plans

Finally, many providers offer a wellness plan as an add-on feature to accident/illness insurance, which help cover the cost of preventive care like annual exams and teeth cleanings.

There are no cat insurance plans that cover pre-existing conditions (but some plans do cover curable conditions after a certain waiting period with no recurring symptoms). If your cat comes down with an illness before your pet insurance kicks in, you’ll have to pay for the veterinary exam fees and treatment costs for that condition out of pocket.

However, many pet insurance plans cover congenital illnesses (illnesses that begin at birth), hereditary conditions, and breed-specific illnesses.

What cat breeds are prone to health problems?

After analyzing pet insurance options for tens of thousands of cats and dogs, Pawlicy Advisor found that these ten cat breeds are most likely to develop health conditions before enrolling in pet insurance:

- Mixed (breed-unkown)

- Domestic Shorthair

- Domestic Mediumhair

- Domestic Longhair

- Siamese

- Russian Blue

- Maine Coon

- Persain

- Ragdoll

- 10.American Shorthair (pure-bred)

With cat insurance, you’ll only have to pay a fraction of the cost for treating these types of illnesses so long as they did not exist before the time of enrollment. Many plans can help you pay for your cat’s prescription medications. Some even cover the costs of dietary supplements, which is a potential treatment for cats with kidney disease.

How to compare cat insurance plans

There are two ways you could compare health insurance for cats: by the cost of a pet insurance plan and or by the coverage it provides.

When shopping for pet insurance with cost in mind, you’ll need to pay attention to the following:

- Annual Deductible: the amount you’ll need to cover out of pocket each year before your insurance kicks in

- Reimbursement Rate: the percentage of covered veterinary costs your policy provider will reimburse you for after you reach your annual deductible

- Annual Limit: the maximum dollar amount your provider will reimburse you for each year

- Monthly Premium: the amount you must pay each month to keep your plan active

You should always check coverage details when considering a pet insurance policy for cats, but if robust coverage is your biggest priority when choosing a plan, be sure to watch out for these terms:

- Benefit Schedule: a list of flat reimbursement rates for health concerns established by some pet insurance providers

- Maximum Payout Per Incident: the most amount of money the provider will reimburse for out-of-pocket costs related to the claim incident

- Claim Expiration: the amount of time a policyholder has to file an insurance claim after an incident occurs

- Waiting Period: the duration of time it takes for the insurance policy to go into effect and coverage to start following enrollment

Pro Tip: Check out our pet insurance dictionary for more clarification plus a list of definitions of terms frequently found in policies that are crucial to know.

Compare Top Pet Insurance Companies Side-by-Side

Use Pawlicy Advisor to get personalized quotes from leading brands and see how each plan stacks up — instantly.

100% free to use. No fees. No commitment.

How to file pet insurance claims

Health insurance for cats doesn’t work the same way as health insurance for humans. Instead, it works in a similar way to car insurance.

When your pet gets sick or needs to go to the vet, you’ll still need to pay the vet for their services. But if you have insurance, you’ll be able to submit a claim to your insurance provider. The pet insurance company will then reimburse you, the pet owner, for a percentage of your costs based on your policy.

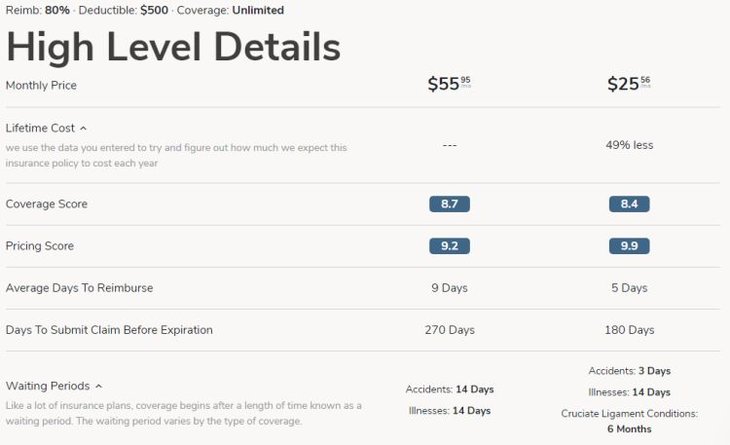

Most pet insurance claims take less only a few days to process, but some claims are processed in less than a week. You can see how quickly each provider typically reimburses customers when shopping for plans on Pawlicy Advisor.

It’s important to remember that only claims for covered costs will be processed and reimbursed. If you have a plan that only covers accidents, you won’t be able to obtain reimbursement for illness treatments. Similarly, if you have an accident/illness plan that excludes coverage for prescription foods, you’ll need to cover those costs out-of-pocket.

The best way to compare cat insurance plans is to see cost and coverage details from leading providers side-by-side. You can spend a few hours creating your own spreadsheet, or you can use Pawlicy Advisor’s comparison tool — there’s nothing else like it on the market.

Pawlicy Advisor's instant comparison charts are a thing of beauty. They make it simple to compare high-level details and coverage information for both plans side by side.

This makes it easy to see which plan is best for your unique cat. It will also help you compare the lifetime cost of each plan, as well as their monthly costs.

How to buy pet insurance for cats

If you’re shopping for cat insurance, generate a personalized comparison with Pawlicy Advisor. All you’ll need to do to compare plans is enter some information about your cat.

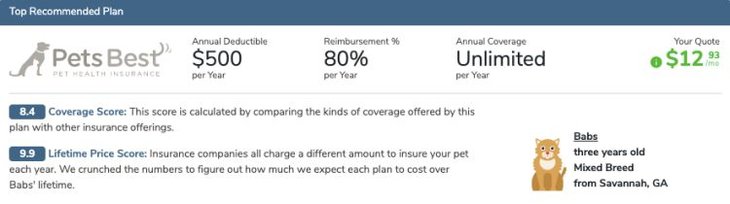

Pawlicy Advisor will use its algorithm to deliver a top-recommended result — a quote that matches your cat’s coverage needs, risk factors, as well as your budget.

Here, you’ll see a recommended plan for a three year-old mixed-breed cat named Babs:

Pawlicy Advisor will provide you with a Coverage Score and a Lifetime Price Score. The Coverage Score tells you how this plan ranks in terms of coverage compared to others that are available (the higher the number, the better). The Lifetime Price Score tells you how much, or how little, the cost of the insurance will go up as your pet ages.

If Babs was older, she'd need a higher level of coverage. Her monthly deductible will also be slightly higher than that of a younger cat because she'd be more susceptible to illnesses.

Aside from the Top Recommended Plan, you can click on “View Additional Plans” below to look at a range of available quotes from the best pet insurance providers.

For example, in Babs’ case, there were 97 other options for insurance! Younger cats will even more options than that.

You can check to see exactly what’s covered under any specific plan by clicking on “Coverage Details” after clicking on a quote. Once there, you’ll get a complete list of the costs that plan can cover:

You can even find plans that cover extra costs like prescription foods and even alternative therapies. You might have to pay a little more on your monthly premium, but this kind of coverage can open entire new pathways of care for your cat.

NOTE: If you have more than one cat, Pawlicy Advisor will automatically apply multi-pet discounts.

Average cost of cat insurance

The above examples paint a fairly good picture of the affordability of cat insurance. On average, accident/illness pet insurance costs about $30 per month for cats.

For younger cats, you can find plans that cost as little as $20 or less per month.

For example, Babs’ Top Recommended Plan was only $12 per month. That’s a plan with good coverage that is totally worth it. It could save Babs' parents thousands of dollars in veterinary costs if Babs develops a serious illness like cancer or kidney disease.

Benefits of cat health insurance

The biggest benefit of cat insurance is obvious. If you get an expensive vet bill, you can pay without worrying about how the cost will impact your finances. But insurance has an additional benefit — not for you, but your cat.

Many pet parents forgo veterinary services because they can’t afford the cost. With pet insurance, you never have to avoid necessary care for your pet. You can go to a routine visit with the without fear of cost, knowing that your furry family member will be covered even if the vet finds something wrong.

More importantly, you’ll have peace of mind knowing that you can cover the cost of emergency care. Hopefully it never happens, but if your cat were hit by a car, attacked by a dog, or diagnosed with a communicable illness like Feline Calicivirus (FCV), a good insurance policy could cover some of the costs of antibiotics, nursing care, and even hospitalization.

Final verdict: is cat insurance worth it?

Yes. If you’re a pet parent, you only want the best for your cat. You can use Pawlicy Advisor to get cat insurance quotes from top providers and instantly compare them side-by-side. You can then customize your ideal plan to suit the precise needs of your unique cat.

The sooner the better, so start today by entering details your cat and your budget, then review your recommendation and personalized quotes to find the best policy. We work with the best pet insurance providers in the business, including the ASPCA, Pets Best, Petplan and more.

There's a reason Pawlicy Advisor is the first pet insurance marketplace actively endorsed by thousands of veterinarians across the US ;)

Key Takeaways

- Cat insurance is worth the cost because it helps offset the financial burden of pet parenting (or fostering!) by reimbursing a portion of your vet bills each year.

- Pet insurance plans are customizable, giving you the freedom and flexibility to find a coverage solution that fits in your budget.

- It's easy to compare the cost of cat insurance on sites like Pawlicy Advisor, and the sooner you enroll, the sooner you can start saving.

References

- PetFinder "How Much Does a Cat Cost?" Accessed June 1, 2021.

- American Veterinary Medical Association (AVMA) "Senior Pet Care FAQ" Accessed June 1, 2021.

Do you want to find the best pet insurance?

Let's analyze your pet's breed, age, and location to find the right coverage and the best savings. Ready?

Analyze My PetAbout Pawlicy Advisor

The pet insurance marketplace endorsed by veterinarians, at Pawlicy Advisor we make buying the best pet insurance easier. By comparing personalized coverage and pricing differences we can save you a ton of money, up to 83% in some instances!

Instantly Compare Pet Insurance Plans

Guides

Determine If Pet Insurance Is Worth It

Comparison Charts

Find Your State

Dog Insurance

Pawlicy Advisor is the #1 pet insurance marketplace in the U.S. Recommended by veterinarians. Trusted by 1M+ Americans. Our team of veterinary advisors and licensed insurance experts are dedicated to helping pet parents give their dogs and cats the best possible care.