Pet insurance is a unique asset. Like auto-insurance or renters insurance, you're buying peace of mind and protection from expensive incidents.

It's one of those things that you buy and hope not to need, but should misfortune strike you'll be really glad to have it. "Better to have it and not need it, than need it and not have it" as the old saying goes.

Now, pet health insurance is different than human health insurance. One major difference - you don't need to find doctors within your provider's network! You can use any pet insurance policy with any licensed veterinarian in the U.S.

Pet insurance companies also pay the policy holder (you, the pet owner!) instead of the veterinary practice, which means you don't have to worry about a copay. Most pet insurance providers will require that you pay upfront for treatment at the time of your vet appointment - but many will reimburse you in a matter of days. Some carriers will even pre-approve you for an upcoming procedure and offer to pay the veterinarian directly, alleviating your potential temporary financial burden.

Below you'll learn the details about how to use pet insurance and three ways to get the best bang-for-your-buck.

How Pet Insurance Works

- Enroll in a pet insurance policy. (Read "How to Find the Best Plan, No Matter the Provider.")

- A short waiting period will need to pass before your policy is activated (check your policy details to see how many days are needed)

- Visit any veterinary practice/clinic that you prefer

- Enjoy the peace of mind that your cat or dog will get the gold standard care they need.

- Pay for your pet’s treatment. (If possible, put it on a credit card. More on this below.)

- Submit a claim to your insurance provider.

- Get reimbursed for your pet’s treatment based on the terms of your insurance policy.

- Relax, and breathe easy.

What Is A "Deductible" In Pet Insurance?

A deductible is the portion of the veterinary bill you're responsible for before your plan’s reimbursement takes effect. Most pet insurance companies offer an annual deductible. Some insurance companies offer a per-incident deductible, meaning if the same injury occurs more than once in future years, the deductible will no longer apply.

What Is My Reimbursement Rate?

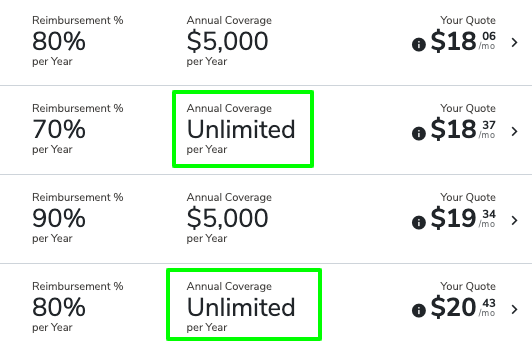

Your reimbursement rate is the amount a pet insurance company pays you back for the cost of care. A typical reimbursement can range anywhere from 60% to 100% of the bill. The most comprehensive pet insurance plans will reimburse 80% to 90% of your total vet bills.

What Are "Limits", And How Are They Different Than "Annual Limits?"

Limits are generally counted "per-incident" (where as annual limits refer to a total for the year) and is something you should investigate when comparing pet insurance options as you anticipate how much and what type of veterinary care your pets might need for their ages and conditions. Per-incident limits cap how much you can be reimbursed for a single illness or accident. If surgery, lab tests, medications, and follow-up care all total $5,000 and your limit is $2,000, than you are responsible for the difference ($5,000 - $2,000 = $3,000).

NOTE: Not sure what type of care your unique pet might need? Use Pawlicy Advisor to scan hundreds of pet insurance policy variations and find the right plan at the best price.

What Do I Need To Know About My Annual Limit?

Annual limits refer to what amount your insurance coverage is capped at. In other words, the dollar amount you can be reimbursed for in one year.

Once you hit your plan’s annual reimbursement limit, you are responsible for paying vet bill costs until your coverage resets for the year.

Depending on your pet, you may not hit the annual limit. The good news is that many pet health insurance options have unlimited annual limits!

Does A Wellness Plan Count As An Insurance Policy?

A wellness coverage plan is separate from your standard accident and illness insurance plan. Wellness coverage does not cover unexpected illness or injury (so no cancer treatment or any urgent care needs). Instead your wellness plan will cover routine care and some preventive care (like vaccinations). It's particularly helpful for new puppy or new kitten appointments.

How To Use Pet Health Insurance Like A Pro

These three tips will ensure you get the best experience possible.

1. Pay Upfront Treatment Costs On A Credit Card, And Pay It Off With Your Reimbursement

Pet insurers do not generally negotiate with veterinary clinics or hospitals - something many veterinarians appreciate, as it prevents dealing the mess of copays and unpredictable treatment costs (#humanhealthinsuranceisanightmare).

With pet insurance, you'll know exactly how much the treatment will cost upfront and how much you'll be reimbursed for. Because the insurance providers pay you instead of your licensed veterinarian, you will need to cover the treatment cost upfront - and you should consider putting it on a credit card.

If your current credit card limit can cover the treatment cost, then by using your preferred card you don't have to touch your bank account and you'll likely be reimbursed much before that card's bill is due. This way you'll be able to pay off the credit card in mere days, before any interest accrues. You'll also be able to take advantage of what ever reward points or cash back percent is available with your card, which could knock an another 1% to 4% off the cost.

If you don't have a credit card that can support your veterinary costs upfront, consider using a similar but alternative payment solution like CareCredit or Scatchpay.

2. Make Sure Your Vet Knows About Your Pet Insurance Coverage

For some reason, many people (too many people) believe that if their veterinarian knows that they have an insurance plan that they'll rack up the vet bill. This is not only untrue, but also unfair to the people that dedicate their lives to helping your beloved pets live happy, healthy lives.

The truth is, that your veterinarian will present all the treatment options for you to consider. But, if they have a better understanding of the resources available they can direct you to the path that makes the most sense.

Think of it this way: greater resources (like insurance) allow for the ability to persue extra-precautionary diagnostics and treatment plans. Often, your veterinarian will have an understanding of what's "wrong" based on their extensive training and experience. But, extra-precautionary diagnostics can hedge your bet on a specific diagnosis and ensure that every stone has been turned.

No vet wants to talk about treatment costs. They chose to be a veterinarian to help you and your animal companions, not to make money. Truly, most veterinarians have just as much student debt as human doctors yet their salaries are only a small fraction of what human doctors make... all while working 60+ hour weeks. (Here's "What Being A Veterinarian Really Takes")

So, tell your vet about your pet insurance coverage - you both deserve the peace of mind to be able to do the right thing for your pet.

3. Make Sure Your Policy Makes Sense For Your Breed, Location, Age, And Any Pre-Existing Conditions

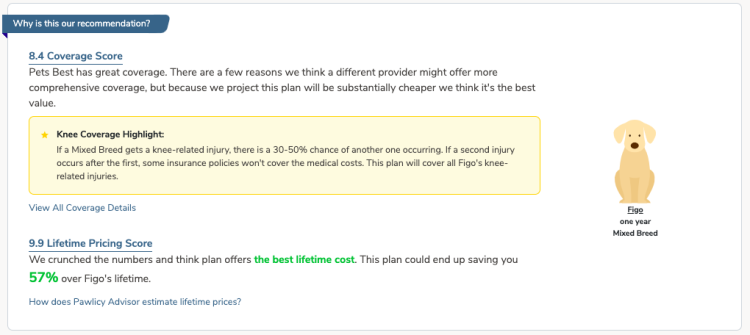

With over 14+ pet insurance provider options, each with various plans, and each ton of policy variations - it can be tricky to find the the perfect fit at the best price. It gets even more complicated when you realize that your pet's breed has a huge impact on what you can expect to pay across the lifetime of your cat or dog.

That's right. One accident or illness plan might be a great fit for a Mini-Aussie, but a poor fit a Great Dane. You see, each policy has fine print that may relate to you pet's unique breed risks.

For example, if your dog is a large breed you might want to avoid the plan that has long waiting periods for knee injuries.

How are you supposed to know what plan has what fine print and find the right coverage for your pet? Well, there's a free tool called Pawlicy Advisor that does all that for you (and more).

It's the smartest way to compare and buy pet insurance. Pawlicy Advisor even helps identify options for pre-existing conditions.