Shifting Perceptions:

The Growing Impact of Pet Insurance on Veterinary Practices in 2023

Shifting Perceptions:

The Growing Impact of Pet Insurance on Veterinary Practices in 2023

Scroll to view report ↓

Abstract

As veterinary practices strive to provide comprehensive and high-quality care, there is a growing recognition of the impact of pet insurance on patient outcomes, client satisfaction, and clinic growth. This report aims to provide a comprehensive analysis of the data that underscores this evolving perspective.

Introduction

After a relatively slow adoption in the United States, pet insurance is now quickly becoming an important topic among veterinary professionals. The concept was first introduced in Sweden the year of 1890 but didn’t make its way to the U.S. until 1982.1 At the time, it was received by the veterinary community with much skepticism and, in some cases, outright opposition.

Early arguments feared the insurance industry would take control of the profession, or create a two-tier system in veterinary medicine — similar to the one created in human healthcare — in which only pet owners with insurance would be able to afford treatment.2 The lack of support in the veterinary community may help explain why pet insurance was slow to catch on in the U.S. for the first over the next 30 years. Until 2002, the market was small and primarily dominated by one insurance carrier, Veterinary Pet Insurance Co. (VPI).1

Organized veterinary medicine was hesitant to embrace the idea of pet insurance due to concerns of potential conflicts of interest. It was not until the early 2000s that pet insurance began to gain traction among pet owners as a wave of new carriers entered the marketplace, introducing more competitive, consumer-friendly products. The number of insured pets in the U.S. nearly doubled between 2013 (1.12 million) and 2017 (1.83 million), then grew by another 17.1 percent by the end of 2018 (2.15 million).3

In 2019, the American Veterinary Medical Association (AVMA) revised its policy to officially endorse pet insurance and began encouraging vet teams to proactively educate clients about how it can be used as a financial tool to help afford veterinary care.4 The objective recommendation relieved previously held fears regarding possible conflicting interests. Strengthening trust further, that same year the North American Insurance Council (NAIC) began drafting a pet insurance model law to be rolled out on a state-by-state basis to help regulate the industry and afford consumers greater protection.5

In recent years, there has been a heightened interest in understanding the quantitative effects of pet insurance on veterinary practices and their clients. Studies such as those funded by the AVMA,6 Nationwide,7 and Pumpkin8 have drawn correlations between pet insurance and increased frequency of vet visits, higher spending, and stronger client loyalty. However, little qualitative research has been done to assess how veterinary professionals perceive pet insurance within their practice considering its surge in popularity over the past five years.

Pawlicy Advisor, the leading independent marketplace for pet insurance recommended by the American Animal Hospital Association, conducted a survey with the goal of understanding exactly that. This report summarizes the data findings of a survey conducted to analyze the shift in veterinarians' perception of pet insurance and its benefits in their practices. Questions we sought answers to include:

- What is the common consensus on pet insurance within the veterinary community?

- How has pet insurance enrollment impacted the ways in which veterinarians perform their jobs or interact with clients?

- Where do vets find the greatest value or biggest opportunities as the industry continues to expand?

- If the old pet insurance narrative in veterinary medicine is one of distrust, fear, and confusion, what does the new narrative look like?

Methodology

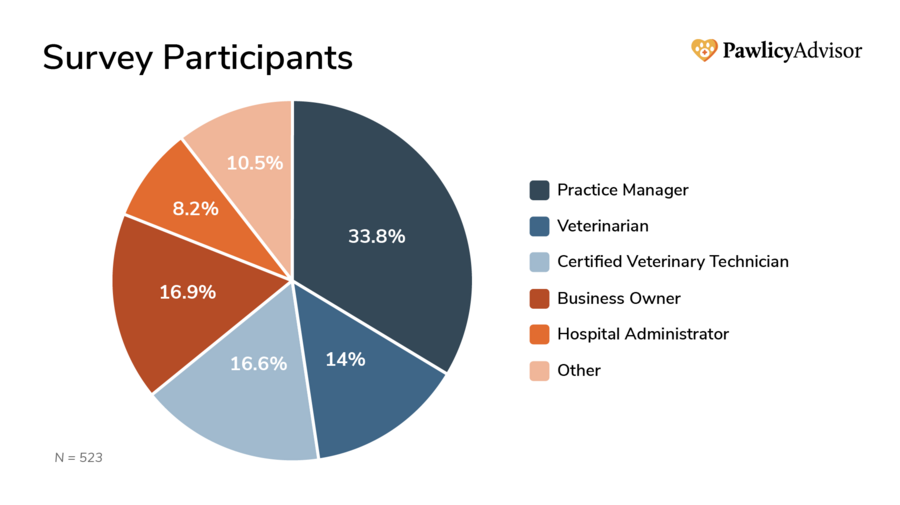

Pawlicy Advisor conducted a comprehensive survey in conjunction with the American Animal Hospital Association (AAHA) to study the changing perspective among veterinary professionals regarding the benefits of pet insurance in their practice. The survey ran from April 10, 2023, until April 24, 2023, and comprised data from a total of 523 respondents that are reflective of the general veterinary population in the U.S.

Participants were asked to state how strongly they either agreed or disagreed with a series of seven statements related to pet insurance. The responses were assigned a numerical value on a scale of 1 (strongly disagree) to 5 (strongly agree) and averaged for each question. The scores were then analyzed to determine the relative importance of each statement and identify the trending consensus.

Research Findings

1. Facilitation of Better Patient Care

Survey data shows that 92 percent of 494 responding veterinary professionals agree that pet insurance leads to better care. It helps ensure that clients are able to say yes to more care and provide their pets with the best possible care.

This viewpoint reflects a recognition that pet insurance empowers pet owners to make timely medical decisions for their animals, unburdened by financial constraints. With pet insurance in place, veterinarians can recommend comprehensive treatments and procedures that align with the best interests of the animal's health, rather than being limited by the client's financial capabilities.

2. Reduction of Stress

Another statistically significant finding is that 89 percent of 496 responding veterinary professionals agree that pet insurance can help to reduce the stress and anxiety that clients may feel about the cost of veterinary care and that this can help to create a more positive and relaxed atmosphere for the clients, and for the veterinary team as well.

The financial burden of unexpected veterinary expenses can place undue stress on pet owners, potentially leading to delayed or suboptimal care for their animals. Pet insurance serves as a safety net, assuaging financial concerns and allowing clients to focus on the well-being of their pets without the constant worry of unanticipated medical bills. Moreover, the positive impact of pet insurance on clients’ well-being alleviates stress for the veterinary staff serving them, helping to reduce employee burnout by improving the overall work environment.

3. Promotion of Practice Growth

Survey data reveals that veterinary respondents also agree that pet insurance promotes practice growth. The statement earned an average score of 4.13 out of 5, indicating the veterinary respondents agree the product improves client satisfaction and loyalty, leading to increased business opportunities.

Clients who have great veterinary experiences with pet insurance are more likely to recommend other pet owners, increasing word-of-mouth client referrals and brand affinity. There was a statistical finding that nonowners agree with this statement more strongly than owners.

4. Importance of Pet Insurance

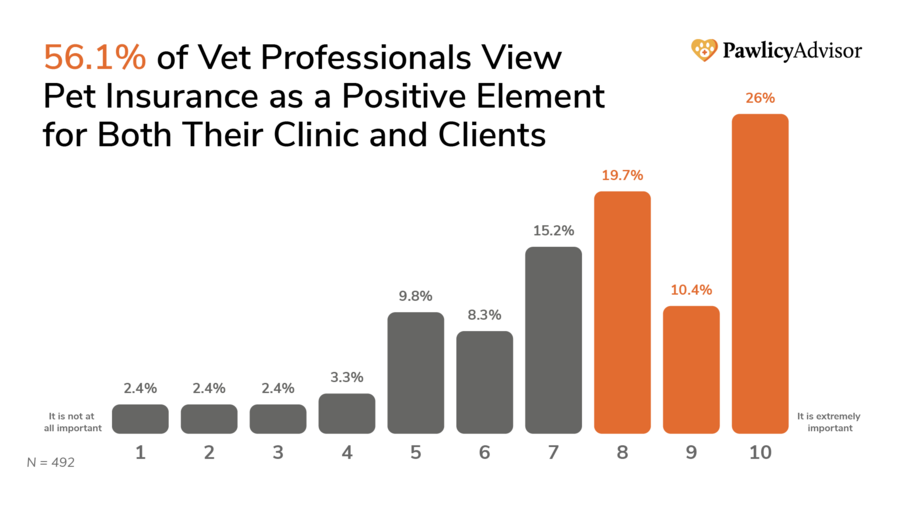

Among surveyed vet professionals, on a scale of 1 (not important) to 10 (extremely important), 26% categorize pet insurance as extremely important, and 36.4% in total are likely proponents of the product (having rated it as a 9 or 10). This indicates a notable shift from pet insurance being considered a supplementary or optional service to it being regarded as an essential component of comprehensive veterinary care.

5. Positive Perception and Clinic Integration

A remarkable 56.1% of veterinary professionals view pet insurance as a positive element for both their clinic and clients (rating 8 - 10). This attitudinal shift underscores the growing integration of pet insurance into the fabric of veterinary practices. As pet insurance gains prominence, it becomes a tool that enhances client relationships and supports the clinic's commitment to high-quality care.

6. Frequency of Discussions

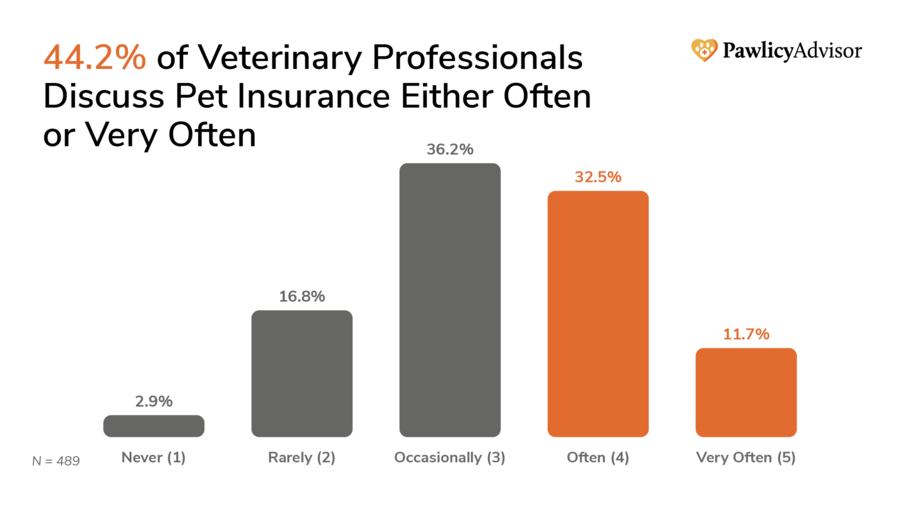

As many as 44.2% of veterinary professionals discuss pet insurance either often or very often, while less than 3% of respondents say they never discuss the topic in the office. A notable observation is that veterinary professionals who agree that pet insurance contributes to a superior veterinary experience are more inclined to engage in frequent discussions about pet insurance. This connection underscores the correlation between positive perceptions of pet insurance and proactive communication with clients.

Conclusion

Survey respondents statistically agree that “Better care” (n=494) and “Reduced Stress” (n=496) are the most recognized outcomes of pet insurance within veterinary practices. Many also agree that pet insurance promotes practice growth. The perception of these outcomes is reinforced by the fact that 56.1% of the 500+ veterinary professionals surveyed view pet insurance as a positive element for both their clinic and clients and 26% categorize pet insurance as extremely important (rating it a 10 on a scale of 1 to 10). With 44.2% of veterinary professionals reporting that they discuss pet insurance either often or very often, the totality of this data demonstrates perceptions of pet insurance have largely shifted away from the skepticism that marked the products 10 years ago and is now often seen as an impactful tool improving experiences within the veterinary community.

Pet insurance now plays an important role in many veterinary practices, and will likely grow in importance if pet owner’s spending power continues to thin with the national economic strains on cost of living and inflation. As the veterinary industry continues to evolve, the adoption of pet insurance best practices is likely to contribute to improved animal health outcomes and enhanced client (and team) satisfaction.

About the Company

Pawlicy Advisor is the #1 pet insurance comparison platform and marketplace committed to helping veterinary teams save time and deliver better care to more patients. Pawlicy Advisor is recommended by the American Animal Hospital Association and offers a solution that streamlines clients’ education and discovery of insurance products with objective, data-driven plan recommendations based on the unique information of each individual pet to match pet owners with the right plan for their coverage needs. Visit pawlicy.com/vet to learn more about Pawlicy’s free resources loved by vet teams.

References

- National Association of Insurance Commissioners. A Regulator’s Guide to Pet Insurance. NAIC, Published 2019. Accessed September 5, 2023. https://content.naic.org/sites/default/files/publication-pin-op-pet-insurance.pdf

- Stowe, J.D. Pet insurance — Essential option? Can Vet J. 2000;41(8):639-644. NLM. Accessed September 5, 2023. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC1476232/pdf/canvetj00020-0057.pdf

- North American Pet Health Insurance Association. State of the Industry Report: 2018 Highlights. NAPHIA, Published 2019. Accessed September 5, 2023. https://www.propertyinsurancecoveragelaw.com/files/2018/08/NAPHIA-SOI-Report-Highlights-2018-1.pdf

- American Veterinary Medical Association. Revised policy encourages proactive education about pet insurance. AVMA, Published August 5, 2019. Accessed September 5, 2023. https://www.avma.org/blog/revised-policy-encourages-proactive-education-about-pet-insurance

- Mattson K. Regulatory standards on pet health insurance being developed. AVMA,. Published January 6, 2021. Accessed September 5, 2023. https://www.avma.org/javma-news/2021-01-15/regulatory-standards-pet-health-insurance-being-developed

- Williams A, Williams B, Hansen CR, Coble KH. The Impact of Pet Health Insurance on Dog Owners' Spending for Veterinary Services. Animals (Basel). 2020;10(7):1162. Published Jul 9, 2020. doi:10.3390/ani10071162

- Nationwide Mutual Insurance. Study: Pet owners with pet health insurance more likely to seek care. Nationwide Newsroom, Published April 15, 2021. Accessed September 5, 2023. https://news.nationwide.com/study-pet-owners-with-pet-health-insurance-more-likely-to-seek-care/

- Mwacalimba K, Gaslunas K. How Pumpkin’s Pet Insurance & Preventive Essentials Provide Value to Pets, Pet Owners, and Veterinary Hospitals TECHNICAL BULLETIN. Pumpkin, Published 2021. Accessed September 5, 2023. https://pumpkin-assets.s3.amazonaws.com/pdfs/Pumpkin+Technical+Bulletin.pdf